The DL Rilancio allows for the simultaneous execution of interventions supported by different types of tax incentives, by transferring or using the related tax credit or discounting the cost directly in the invoice.

As a result, a “mix” of facilitated interventions (90% Facade Bonus, 50%-65%-75% deductions) could lead to an economic/tax advantage even without using the Superbonus 110%, for example in all cases where it is impossible to achieve the two energy classes improvement required due to the complexity of the interventions to be carried out, or the inability to reach condominium agreements.

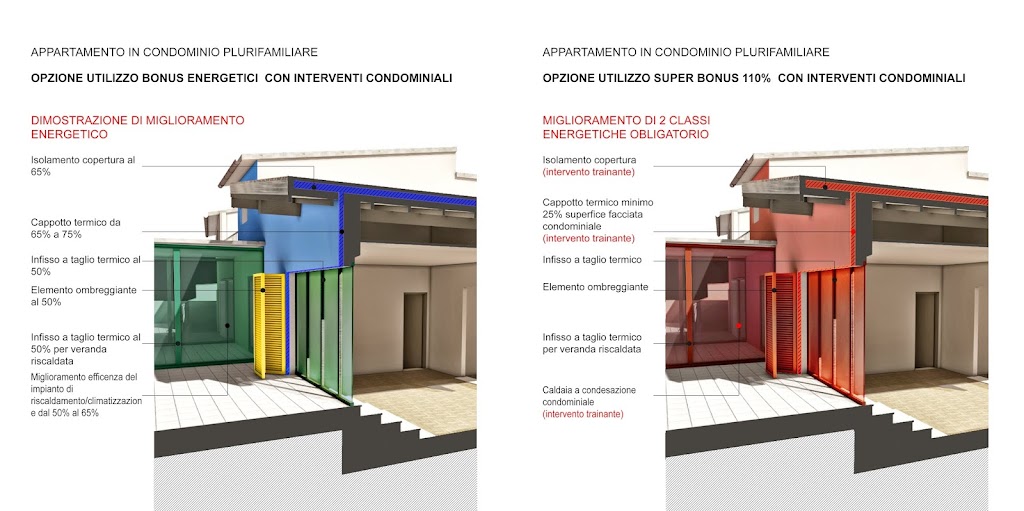

Given this, a key factor for the best use of tax incentives is certainly the setup of the intervention, which from the pre-feasibility phase must define clear technical and economic/tax scenarios to allow the best choice for the proposing party. Subsequently, in the project phase, it is essential to be able to integrate the various sector-specific skills to easily achieve the predetermined objectives. In both of these phases, a virtualized approach to the chosen scenario can be helpful, for example through BIM tools, which are useful for understanding the project even by non-technical subjects.

The regulatory framework, to which the interventions in question refer, is a case of particular legislative stratification that can only be tackled by applying cross-disciplinary technical knowledge and using tools that integrate skills capable of optimizing and standardizing the approach.

In the example, various interventions that can be implemented benefiting from the Superbonus 110% or, if impossible, using the tax advantages of the 50%-65%-75% deductions are graphically represented.